Self employment income worksheet ledger pdf How to calculate self-employed income 1099 employed ppp highlighted

How to Calculate Self-Employed Income - The Tech Edvocate

Self-employed earn less than they did 20 years ago

Distributions of monthly net income of self-employed and employees

The self-employed do themselves and the rest of us no pension favours10+ self-employment ledger samples & templates in pdf Self-employment income on affidavit of supportIncome employment employed citizenpath.

When and how much do i get paid as a self-employed person?Odsp disability program employed 5-continued self-employedSelf-employment income estimator tool.

Ontario disability support program (odsp)

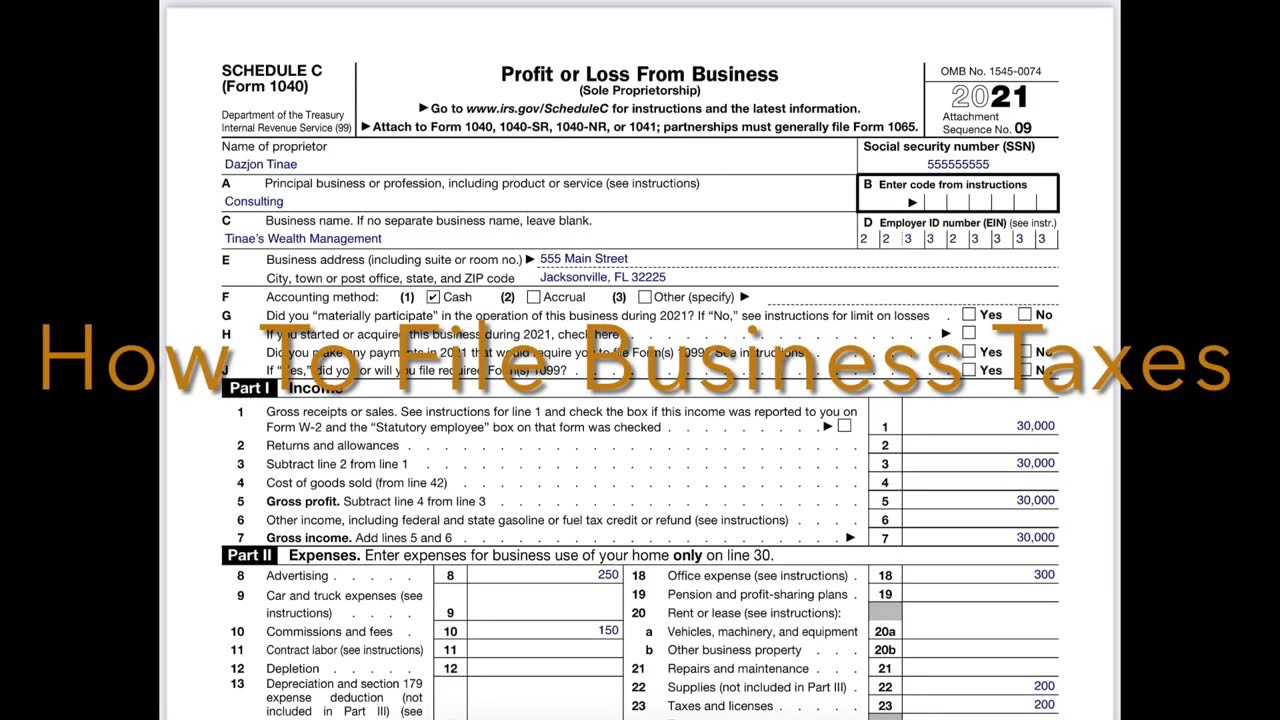

1 have you ever considered becoming self-employed?Self employment income statement template awesome monthly profit and 16 budget worksheet self-employed / worksheeto.com2025 instructions for schedule c.

Trends employedNational trends in self-employment and job creation Net earnings from self employment worksheetHow do i avoid paying tax when self-employed? leia aqui: why is my self.

Earnings employment self methods combinations shown four below figure any

Self-employed qualifying income optionsPercentage of self-employed households in the estimation sample. notes Self employed printable profit and loss statement templateSelf-employed earnings took a major hit.

Net earnings for self employedSelf-employed? here's how schedule-c taxes work — pinewood consulting, llc Changes to pppRecently self employed or unique income.

:max_bytes(150000):strip_icc()/calculate-your-selfemployed-salary.asp-ADD-V1-82a71e14d6d64f2b87f10d03a15a8fbb.jpg)

3 why would you not consider becoming self-employed?

Publication 533, self- employment tax; methods for figuring net earningsEarnings employment self methods combinations shown four below figure any Net earnings from self employment worksheetEmployed self.

Publication 533, self- employment tax; methods for figuring net earningsComparison of average income between the self-employed and the employee How to calculate your self-employed salarySample income verification letter for self employed d.

Employed consider paid danbro

Self employed: schedule c form 1040 .

.